Life Insurance in and around Lewisburg

Coverage for your loved ones' sake

Life happens. Don't wait.

Would you like to create a personalized life quote?

Protect Those You Love Most

People obtain life insurance for several different reasons, but the main purpose is almost always the same: to ensure the financial future for your family after you perish.

Coverage for your loved ones' sake

Life happens. Don't wait.

Lewisburg Chooses Life Insurance From State Farm

Service like this is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If tragedy strikes, Peggy Hubbard is committed to helping process the death benefit with care and consideration. State Farm has you and your loved ones covered.

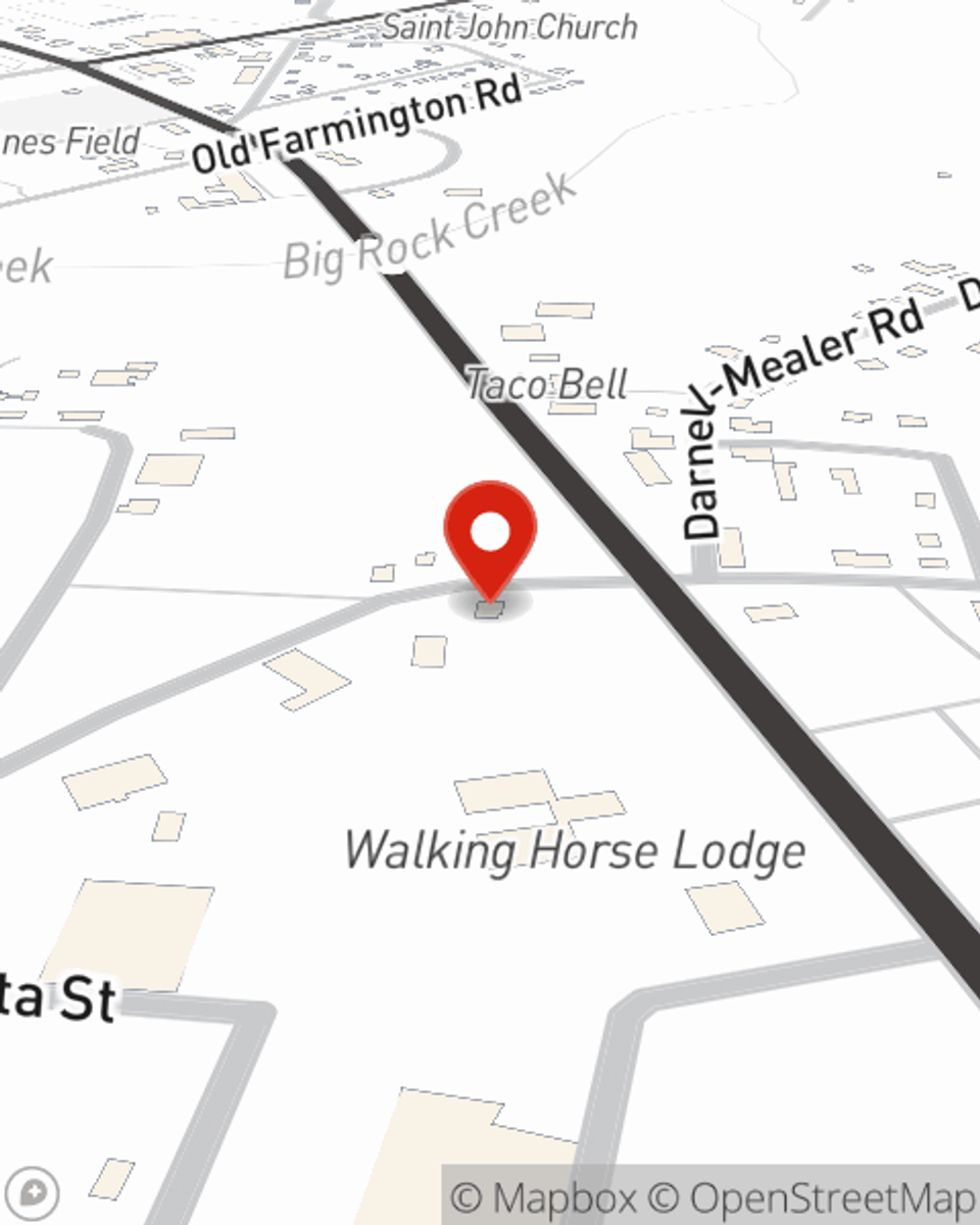

Reach out to State Farm Agent Peggy Hubbard today to experience how the leading provider of life insurance can care for those you love most here in Lewisburg, TN.

Have More Questions About Life Insurance?

Call Peggy at (931) 359-3998 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Peggy Hubbard

State Farm® Insurance AgentSimple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.